INSTITUTE INDEX: Keeping the expanded child tax credit would ease the South's child poverty crisis

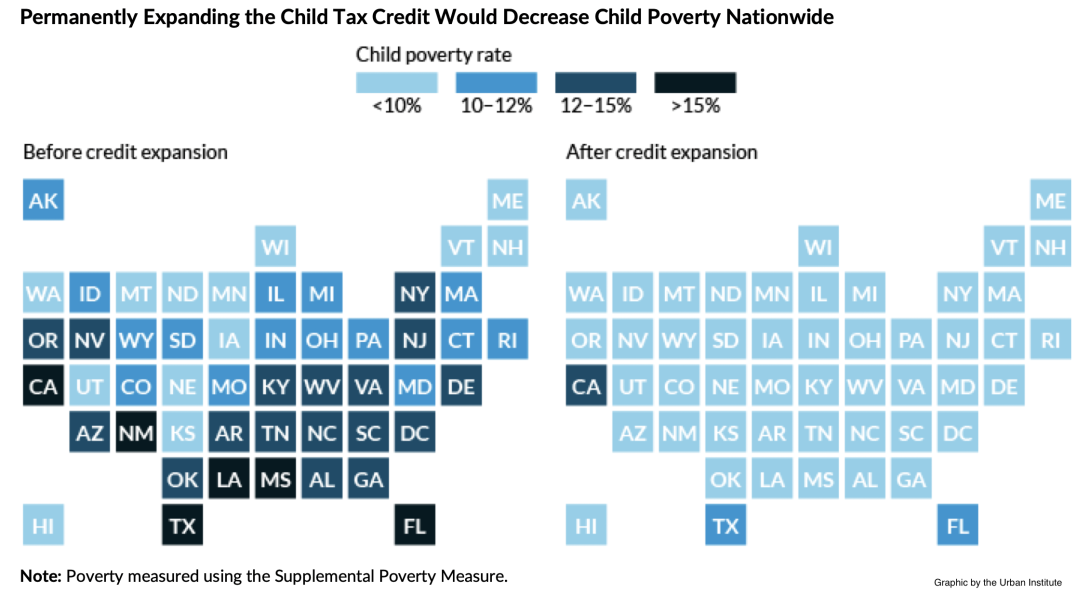

If Congress were to extend to 2025 the child tax credit it expanded earlier this year, it would dramatically reduce child poverty in the Southern states where it's now concentrated. (Graphic by the Urban Institute.)

Month in which U.S. families with children began receiving advance child tax credit payments from the federal government because of a provision in the American Rescue Plan passed by Congress and signed by President Biden earlier this year: 7/2021

Amount to which the law increased the total annual credit from the previous $2,000, while adding a $600 bonus for children younger than 6: $3,000

Average amount of the first round of payments, which are set to continue just through this tax year: $423

Percent of U.S. parents receiving the expanded credit who immediately spent the money, according to a survey by the nonprofit advocacy group Parents Together Action: 79

Percent who spent it on utilities: 45

Percent who spent it on food: 48

From the time the payments began in July to early August, decline in the number of U.S. adults living in households with children that reported not having enough to eat: 1/3

Estimated number of children in families that didn't qualify for the full credit under the old rules because their incomes were too low but that are now receiving the full credit: 26 million

According to research by the Urban Institute, percent by which the congressional Democrats' plan to extend the expanded child tax credit to 2025 as part of a proposed tax-and-spending bill would reduce child poverty in a typical year: more than 40

Rank of the South among U.S. regions with the highest child poverty rate: 1

Factor by which the South's child poverty rate of 45.1% exceeds that of the West, the region with the second-highest levels: almost 2

Before the temporary child tax credit expansion, number of the 13 Southern states* in which child poverty rates were over 12%: 13

If the expanded credit were extended to 2025, number of the 13 Southern states that would still have child poverty rates over 12%: 0

Number of children in Southern states who would be lifted from poverty by extending the expanded credit: 1.8 million

With Republicans attacking the extension proposal as "welfare without work," date on which U.S. Sen. Joe Manchin — a West Virginia Democrat often at odds with his party, which holds a narrow majority in the chamber — appeared on CNN's "State of the Union" and discussed the possibility of imposing work requirements, which research has shown block government benefits from reaching those who need them most: 9/12/2021

According to a new study by researchers with institutions including Appalachian State University and the University of North Carolina at Greensboro, percent of expanded child tax credit recipients who said they intended to do the same amount of paid work or more: nearly 94

Number of children in West Virginia alone who could be lifted out of poverty by extending the expanded credit without work requirements: 25,000

* Facing South defines the region as including Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Texas, Virginia, and West Virginia

(Click on figure to go to source.)

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.