INSTITUTE INDEX: Climate watchdogs challenge Duke Energy's polluting 15-year plan

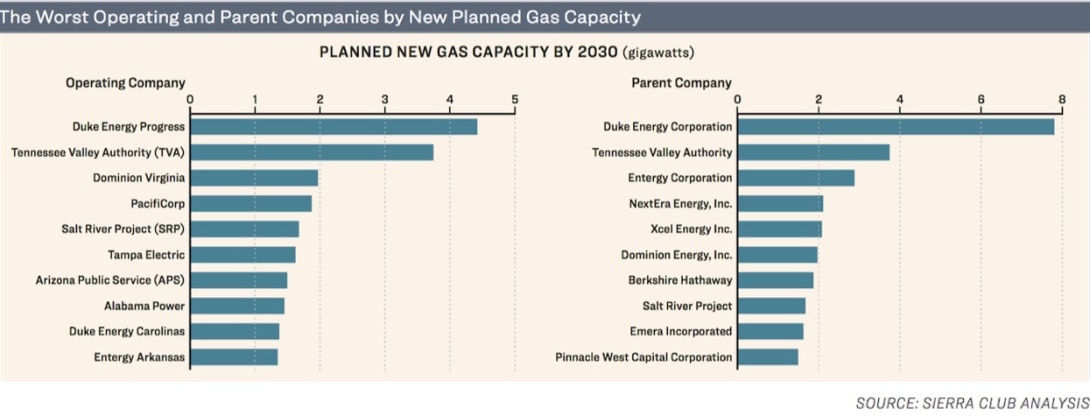

Despite the risks to the climate and ratepayers, Duke Energy is planning to build far more new fracked gas infrastructure than other utility companies. This chart is from "The Dirty Truth About Utility Climate Pledges," a report released by the Sierra Club earlier this year. The data used for the analysis is available here.

Date on which the North Carolina Utilities Commission (NCUC) will hold a public hearing about Duke Energy's latest Integrated Resource Plan (IRP), a biennial blueprint for how the company intends to generate electricity for the next 15 climate-critical years: 3/16/2021*

Under Duke Energy's proposed base plan without a carbon policy in place, megawatts of new gas generation capacity the company would build: 9,600

Under its proposed base plan with a carbon policy, megawatts of new gas generation capacity it would build: 7,350

Factor by which Duke Energy's planned building of gas infrastructure exceeds that of the second-place utility parent company nationally, the Tennessee Valley Authority: more than 2

Considered over a two-decade timeframe, number of times more potent methane — the primary component of natural gas — is compared to carbon dioxide, another heat-trapping gas released when fossil fuels are burned: 84

According to a challenge to Duke's IRP filed by the climate justice group NC WARN and the Center for Biological Diversity, factor by which the company lowballed cost estimates for new gas plants compared to what it actually paid for recent construction: 1/2

Also according to that challenge, percent more power Duke Energy had than needed on even the coldest days in 2019, undercutting its argument that it needs more gas-fired plants to avoid shortages: 40

Year by which President Biden's climate plan requires utilities to stop burning gas and coal: 2035

Under North Carolina's own Clean Energy Plan, percent by which the electric power sector must cut greenhouse gas emissions over 2005 levels by 2030 — a goal that an analysis by a coalition of environmental groups found Duke Energy's latest IRP fails to meet: 70

Should Duke Energy build new gas infrastructure that it then has to shutter because of climate policy, amount in so-called "stranded assets" the company could be on the hook for, according to a recent report by the North Carolina-based Energy Transition Institute: around $5 billion

The potential cost of those stranded gas assets to each of Duke Energy's ratepayers in the Carolinas: $1,000

Number of major North Carolina companies that recently submitted comments on the IRP in which they call on Duke Energy and regulators "to better prioritize cost-effective clean energy resources over polluting, uneconomical ones" and specifically cite concerns about stranded gas assets: 8**

Percent of Duke Energy's electricity that came from renewable sources as of 2019: 5

Percent average for utilities nationwide: 18

Percent of its electricity Duke Energy plans to generate from renewables by 2030: 14

Part of a new regulatory trend giving environmentalists hope, date on which Virginia's utility-overseeing State Corporation Commission rejected Dominion's IRP over concerns about its reliance on polluting and costly fossil fuel infrastructure and its environmental justice impacts — the second time in the past three years the state's regulators have rejected the company's plans: 2/1/2021

Month in which the utility-regulating Public Service Commission in South Carolina — a state that has been rocked by a scandal involving a multibillion-dollar failed nuclear power project — also rejected Dominion Energy's IRP outright for failing to minimize costs and risks to ratepayers: 12/2020

Date on which a public hearing about Duke Energy's IRP is scheduled in South Carolina: 4/26/2021

* The deadline to sign up to speak at the North Carolina hearing is March 11 at 5 p.m.

** Biogen, Burt's Bees, Cree Lighting, DSM North America, New Belgium Brewing, Novozymes, Sierra Nevada Brewing, and Unilever.

(Click on figure to go to source.)

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.