Up the Downscale Market

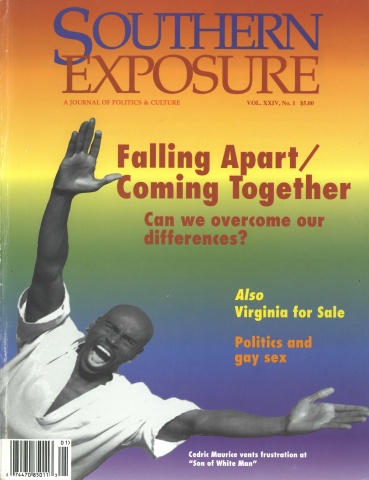

This article originally appeared in Southern Exposure Vol. 24 No. 1, "Falling Apart/Coming Together." Find more from that issue here.

The last time Southern Exposure updated readers on the poverty industry (fall 1994 as a followup to “Poverty, Inc.,” issue in 1993) some companies had been hit with record fines for their price gouging and fraud. But the penalties didn’t slow down the burgeoning market for lenders and other businesses that target low-income and credit-impaired consumers.

In fact, the “downscale” market has continued to attract big investors. High-rate loans on cars and houses make up the biggest parts of this $200 billion to $300 billion a year “poverty industry.”

Local mortgage lenders targeting the disadvantaged have given way to regional companies, which in turn have given way to nationwide high-interest lenders. “A tragic thing is occurring — Wall Street and these giant corporations have realized that poor people don’t have much, but the little that they have is accessible to them,” says Bill Brennan, a Legal Aid attorney in Atlanta. He has a firsthand view of the effects of loans with exorbitant rates. With so many poor people in America — especially in the South — “it adds up and becomes big numbers.”

One thing that’s fueling the growth in the downscale home-loan market is the proliferation of “mortgage-backed” securities on Wall Street. These investment products, which are backed by the income streams from “bundles” of home loans, have become increasingly popular among high-rate mortgage companies.

“It’s resulted in a boom of cash being thrown at these lenders,” says Jonathan S. Hornblass, publisher of Home Equity News, an independent newsletter. “Finding the money to make the loans used to be the hardest thing about this business. Now they just have too much money.”

Hornblass concedes “there are some nightmare stories” about people being ripped off in the burgeoning home equity market. But he says mortgage securities have helped nudge down rates for disadvantaged borrowers and helped provide loans for people who have nowhere else to go. “It’s a tough call. I think it basically boils down to whether you’re in favor of debt or against it. This country has really been built on debt.”

But Brennan and other critics say mortgage securities have opened up a huge pool of cash for predatory lenders. This has allowed them to expand their reach in low-income and minority communities. Lawsuits and government investigations across the South indicate that fraud and price gouging are still common in the high-rate mortgage industry — and in other businesses that target vulnerable consumers.

A growing number of Southerners are trying to change this. To fight for better protections for low-income and blue-collar consumers, a group of attorneys and community activists have joined the American Association of Retired Persons to create the Consumer Law Center of the South. Based in Atlanta, the center will fight for reform via legislation, litigation, and regulation.

Meanwhile, fair-lending activists continue to win concessions from banks. In December, Charlotte-based NationsBank Corporation agreed to offer $500 million in flexible and inexpensive mortgages in low-income neighborhoods in Charlotte, Atlanta, and other cities. The loans will be tunneled through a union-affiliated group, National Assistance Corporation of America, which is already running a $140 million loan program offered by Fleet Financial Group.

Greed Index

Some big companies have been accused of fleecing low-income and minority consumers

Mercury Finance Co., the nation’s leading financer of car loans for people with bad credit, was hit with a $50 million jury verdict in Alabama. A customer accused it of padding a $3,000 car loan with a hidden charge of $1,000. The trial judge later reduced the verdict to $2 million.

Payco American, one of the nation’s largest debt collectors, agreed to pay $500,000 to settle charges it harassed consumers, the Federal Trade Commission said. Payco heaped debtors with obscenities and falsely threatened them with arrest. It was the largest fine ever under the U.S. Fair Debt Collection Practices Act.

Ford Motor Credit Co. has agreed to pay more than $120 million to settle allegations that it illegally inflated car buyers’ loans by adding in overpriced accident insurance. The charges involved at least 650,000 borrowers nationwide.

Barnett Banks of Florida paid $19 million to settle similar “force-placed” car insurance allegations. One Barnett borrower, for example, ended up with a $1,500 insurance bill after paying off a $4,000 loan.

Tags

Michael Hudson

Mike Hudson is co-author of Merchants of Misery: How Corporate America Profits from Poverty (Common Courage Press), and is a frequent contributor to Southern Exposure. (1998)

Mike Hudson, co-editor of the award-winning Southern Exposure special issue, “Poverty, Inc.,” is editor of a new book, Merchants of Misery: How Corporate America Profits from Poverty, published this spring by Common Courage Press (Box 702, Monroe, ME 04951; 800-497-3207). (1996)