Reforming High Finance

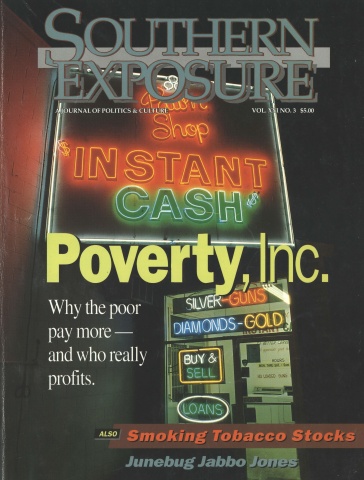

This article originally appeared in Southern Exposure Vol. 21 No. 3, "Poverty, Inc." Find more from that issue here.

It was a rare sight under the dome of the Georgia state capitol, where white lawmakers and business lobbyists are used to being in the majority. Last February, hundreds of black citizens packed a committee room and choked the hallway outside. They came to support a bill to cap the huge interest rates that poor and minority homeowners pay on second mortgages.

With millions of dollars in bank profits on the line, Loyce Turner — chair of the Georgia Senate banking committee and a banker himself — moved to squelch the uprising. Turner warned the audience not to clap or shout support as the bill’s sponsor, State Senator David Scott, made his plea for the rate caps. He also said that because the meeting was not a public hearing, the assembled citizens had no right to speak to the committee. “We are not trying to railroad or stop anything,” Turner said.

Scott didn’t try to hide his anger. “If this committee isn’t going to represent the people, I don’t want to serve on it,” he said. “This is a strong miscarriage of justice. If this room was full of white people, this wouldn’t happen. The banks run this committee.”

The committee put the bill aside, but continued pressure from citizens and the media paid off. After Scott agreed to raise the rate cap by three percentage points, the committee passed the bill on to the full Senate, which approved it by a vote of 44-11.

It seemed like a great victory for consumers. In the end, however, the banks won. When a House panel — also chaired by a banker — took up the bill, the pockets of its five members had already been lined with nearly $8,000 in campaign contributions from lenders. With industry lobbyists packing the meeting room, the subcommittee killed the rate-cap legislation. “They don’t want this bill whichever way we write it,” Scott lamented.

It’s an old story in Georgia and in statehouses across the South, where consumers have won few victories over the past decade and a half. Consumer laws in the region remain weak and ineffective — thanks to the predominance of free-market-at-any-cost rhetoric, confusion at the grassroots, and generous campaign contributions from banks and other financial businesses.

The result is a patchwork system of state and federal regulations that effectively exempts low-income and working-class consumers from government protections that more affluent consumers take for granted when they enter a bank or S&L. Across the region, predatory lenders operate virtually unchecked. No Southern state except Georgia regulates fees charged by check-cashing outlets. All but two allow pawn shops to charge interest rates of 240 percent or more. Most put no limits — or extremely high ones — on the interest and fees charged by finance companies and second-mortgage lenders. And government regulators have only recently shown much interest in making banks obey fair-lending laws.

Jean Ann Fox, president of the Consumer Federation of America and its Virginia affiliate, says the message to disadvantaged consumers is simple: “You’re on your own, and we’re not going to protect you. We’re putting our trust blindly in competition — even though competition doesn’t work when consumers don’t have a real choice.”

Stop the Shark

But as the turnout for the Georgia hearings indicates, things are beginning to change. More and more, consumers who have been gouged and ripped off are pressuring their lawmakers to clean up the financial system.

In Atlanta, a grassroots group called Citizens for Fair Housing has sprung from experiences with Fleet Finance and other lenders that prowl the second-mortgage market. In nearby Augusta, a similar coalition, Citizens Addressing Public Service, has marched on Fleet headquarters wearing bright yellow T-shirts that say, “Stop the Fleet Loan Shark.” Members of CAPS have taken the bus north to lobby Congress and the Federal Reserve Bank.

Union Neighborhood Assistance Corporation, an offshoot of a Boston hotel workers union, is coordinating a national grassroots campaign against Fleet and other predatory lenders. UNAC has set up a toll-free consumer hotline — 1-800-96-SHARK — and has pressured corporations that own shares in Fleet to sell their stock.

Community-reinvestment advocates like ACORN — Association of Community Organizations for Reform Now — are stepping up the pressure on banks to lend money and provide services to low-income and minority neighborhoods. The second-mortgage scandal across the South has provided them new ammunition in their fight against lending discrimination by bringing forward people who can attest, in a very personal way, to its effects.

Dorothy Thrasher, a 61-year-old homeowner in northwest Atlanta, told state legislators how two vinyl siding salesmen pressured her for weeks with an offer to make her home a low-cost demonstration model. She finally gave in, and ended up with an $18,000 home-repair loan at 23 percent interest. Fleet Finance purchased the loan and began collecting the monthly payments of $335, leaving Thrasher only $90 from her government pension check to buy food, utilities, and medicine.

“When I testified, I just told the truth about what those people had done to me,” Thrasher says. “The whole place was filled with so many sad folks, most worse off than me. I felt like we was going to get some response, but I was disappointed. It looks like Fleet has too much control. They got the money, and all we got is our stories.”

Money and Votes

Why weren’t those stories enough to sway the legislature? An examination of campaign finance reports indicates why lawmakers remain deaf to the voices of disadvantaged consumers — and why legislation to protect consumers is so often subverted in Georgia and other Southern states.

The banking industry is a patron of most key members of the Georgia legislature:

▼ The 10 members of the Senate banking committee received a total of more than $22,000 from the lending industry last year. On the House side, the 25 members of the banking panel — including those who killed the rate-cap bill — pocketed over $29,000 in contributions from the banking industry.

▼ Turner, chair of the Senate bank committee, has received nearly $7,000 from the banking industry since 1990, including $1,000 from NationsBank. The Charlotte-based banking giant has drawn criticism for its recent purchase of Chrysler First, a huge mortgage company accused of predatory lending against low-income borrowers.

▼ Senator Chuck Clay, the committee vice chair, took in more than $3,000 from banks last year, including $500 from NationsBank. He is also representing Fleet Finance in a class-action suit charging the company with racketeering and fraud.

▼ The Georgia Mortgage Bankers Association funneled more than $18,000 in campaign contributions to Georgia lawmakers last year through its Good Government Fund.

▼ Three key members of the House and Senate banking panels are bankers themselves. Turner chairs First Bank and Trust Co. of Valdosta and is a director of its holding company, Synovus Financial Corp.

Other Georgia politicians also enjoy close ties to the industry. Governor Zell Miller received $9,600 from Fleet’s PAC during his 1990 campaign. Fleet said Miller gave a motivational speech at a company management meeting a few years ago.

With industry money in their pockets, legislators replaced the rate-cap bill sponsored by Senator Scott with one requiring licenses for mortgage brokers. Legislative leaders say licensing will stop “99 percent” of mortgage abuses. Consumer advocates say it’s a minor reform designed to head off real regulation. Second-mortgage lenders can currently charge annual interest rates of 60 percent; Scott’s bill would have capped interest at 11 points over the prime rate.

Guarding the Henhouse

Like other Southern legislatures, the Georgia assembly has always been hostile to regulations on business. Culver Kidd, a Georgia slumlord and president of a string of small-loan companies, fought fiercely against business regulation during his 45 years as a state legislator. “He would let nothing come through that looked like consumer protection,” recalls Donald Coleman, an Atlanta Legal Aid attorney.

Kidd also helped his silent business partner win appointment as a judge in Baldwin County, where he ruled on collection actions against their tenants and borrowers. Before Kidd was voted out of office last year, the powerful Democrat — known around the Capitol as the “Silver Fox” — sponsored a bill that would have discouraged his customers and other small borrowers from filing bankruptcy.

Despite Kidd’s loss, good-old-boy politics and corporate power maintain a stranglehold in Georgia. Across the region, a number of trends over the past decade have left disadvantaged consumers even more vulnerable:

▼ Budget cuts have forced many consumer-protection agencies to curtail their already modest efforts. In Virginia, the state Office of Consumer Affairs has laid off workers and eliminated its toll-free hotline for citizen complaints. Reagan-era budget cuts and growing caseloads have also forced many Legal Aid programs — which provide legal advice to the poor — to cut back on their consumer efforts.

▼ Many newspapers and TV stations have given up hard-edged consumer reporting in deference to advertisers, and to owners who increasingly value profits over public service. In North Carolina, for example, the Raleigh News and Observer transferred its auto and real estate editor to the advertising department. The reason? Executive Editor Frank Daniels III says the paper does little real reporting on the car business because “it doesn’t make much sense to piss off advertisers.”

▼ Government cutbacks and increasing poverty in many communities have forced advocates for the poor to concentrate on providing for immediate needs like homeless shelters and food. In the midst of a lingering recession, the fight for better finance laws and long-term reforms has often taken a back seat.

The Reverend Minnie Davis, chair of the newly formed citizen coalition in Augusta, says that many people assume that financial reform has “been taken care of, somebody’s handling it. They find out it’s really not being taken care of — and we’re really in a stew.”

With consumer attention diverted over the past decade, many states passed “deregulation” bills that reduced protections for consumers — often with little or no opposition. In 1983, Georgia lawmakers opened the flood gates to second-mortgage abuses by eliminating a 16-percent interest cap. The proposal to kill the cap passed the House that year by a vote of 156-0. “The votes were lined up in favor of that bill long before the opposition even heard of it,” former State Senator Todd Evans remembers.

Massive Resources

Such obvious pro-business maneuvers will be harder to pull off in the future, however. The statewide scandal over second mortgages has sparked a sense of sustained outrage among low-income consumers and their allies. Grassroots advocates, attorneys, government regulators, and Atlanta newspapers have joined forces to put heat on lenders who profit from the poor — and on the lawmakers who support them.

But citizens fighting for reform face an uphill battle against the massive resources of predatory lenders like Fleet. The bank — the 14th-largest in the nation — has hired the Atlanta law firm of former U.S. attorney general Griffin Bell, who represents George Bush in the Iraq-gate scandal. It set up a $30 million fund to repay borrowers who have been wronged, hoping to stave off criminal investigations in other states. It held a press conference with Atlanta Mayor Maynard Jackson to announce an $8 million donation to revive minority neighborhoods. And it has tried to shore up its image by joining with the National Consumer League, a respected non-profit group, to start a financial-education program for high school students.

Other lenders have tried different methods for ducking lawsuits and government investigations. After it was hit with millions of dollars in lawsuits, ITT Financial Services began having borrowers sign agreements requiring that most disputes be decided by a private arbitration firm called Equilaw.

Equilaw tells creditors like ITT that arbitration puts an end to “excessive jury verdicts.” But a California judge has ruled that the arbitration program illegally denies borrowers the right to sue, and a Florida lawsuit says the arbitration clause is unfair because it imposes a $750 hearing fee on consumers and suggests they must travel to Minnesota for a hearing.

“Basically you can create a collection agency with ultimate powers if you call it an arbitration organization,” says Gloria Einstein, a Legal Aid attorney in Jacksonville, Florida.

Consumer advocates have had some success in exposing abusive practices at Fleet and ITT. But things remain business as usual for most companies that profit from the poor. Even as the second-mortgage industry has come under siege in Georgia, small-loan companies in the state continue to operate under some of the worst lending laws in the nation.

With the help of sympathetic legislator-businessmen like Culver Kidd, the small-loan industry has blocked attempts to improve fair-lending laws. The industry PAC, Consumer Credit People for Responsible Government, tells members that campaign contributions are crucial to their profits, because the industry is “a creature of the General Assembly.” Last year, the industry dished out more than $28,000 to state lawmakers.

Such influence-buying has paid off. Georgia law allows small-loan companies to collect stunning interest rates: from 123 percent on a $50 loan to 45 percent on a $1,000 loan.

The rent-to-own industry also enjoys legislative sponsorship for price-gouging, thanks to a strategy of preemptive regulation. In state after state over the past decade, rent-to-own lobbyists have persuaded lawmakers to introduce industry-sponsored bills that include token protections for consumers, such as requiring that stores be honest about whether an item is new or used. More important, the legislation exempts rent-to-own stores from retail credit laws and traditional interest-rate caps.

Legal Aid attorneys call it “disclose and anything goes.” So far, at least 35 states — including 11 in the South — have passed such laws. And the industry is now lobbying Congress to pass a similar federal law.

When it cannot head off regulation early, the industry attacks. In 1983, North Carolina legislator Jeanne Fenner introduced a bill to limit what rent-to-own stores could charge. The measure was gutted, but the industry still took revenge. During Fenner’s next two campaigns, rent-to-own dealers from as far away as Texas gave more than $20,000 to her opponents. Fenner, who spent a fraction of that, lost both races. Since then, there has been no serious attempt in North Carolina to pass a law to limit finance charges at rent-to-own stores.

Food at Christmas

Consumer advocates say changing the economic patterns that allow rent-to-own dealers and the rest of the poverty industry to thrive won’t be easy. They call for a comprehensive range of steps to reform the system, citing the need to:

▼ educate consumers about their rights and create effective organizations to ensure that grassroots voices are heard at the local and state levels.

▼ pass immediate regulations to limit the usurious interest and fees charged by pawn shops, check cashers, finance companies, second-mortgage lenders, and used-car dealers.

▼ create a unified system of federal regulation that puts the entire financial industry under one set of standards, requiring all lenders to disclose financial transactions, end racial discrimination, and provide loans in poor neighborhoods.

▼ expand nonprofit, consumer-based alternatives such as community credit unions and empower people to create their own economic development initiatives from the bottom up.

Ultimately, consumer advocates say, real reform depends on shifting the control of credit from huge corporations to local communities. Backed by current fair-lending laws governing mainstream banks, grassroots groups have already forced some commercial lenders to promise millions in loans for credit-starved neighborhoods. But so far, critics say, most pledges of community reinvestment are just so much public relations.

In Atlanta, Carrie Copeland has been trying for years to get downtown banks to open up to her fellow public housing residents. Copeland wants banks to lower the minimum balance they require for checking accounts — which run as high as $200 — to $25.

“The banks are good at everything except banking,” Copeland says. “Other things, helping us in the community, they’re very good at that. They give food at Christmastime. They never turn us down on good things like that. But we want to go a step further. We want to save a little money.”

Other activists are starting to make the connection between banking discrimination and predatory lending. In Augusta, CAPS has gone from raising hell about Fleet to pressuring local banks to lend money in redlined neighborhoods and appoint minorities and women to their boards of directors.

The group started early this year. Its first meeting drew 60 people. The next, more than 300. They marched on Fleet, on the state Capitol, and on Washington.

“We have so many people in this area who have been hurt by Fleet,” says Davis, who chairs the group. “They’re just hard-working people trying to make a living.” But it took a while for them to get organized. Most thought they were all alone — that they had somehow brought their problems on themselves.

“They were ashamed at first, because nobody was saying anything,” Davis says. “When other people start speaking out, they kinda overcome their shyness and say, ‘That’s happened to me, too. You need to do something to help these people.’”

Next year, when the Georgia assembly meets, CAPS will be there. So will Dorothy Thrasher and Citizens for Fair Housing in Atlanta. Working together, they will try again to overcome the financial power of the lending industry.

“I feel like one day some good will come out of it,” Thrasher says. “You can’t keep mistreating people and have the problem ignored forever. God doesn’t let good people suffer and suffer without no justice.”

Tags

Michael Hudson

Mike Hudson is co-author of Merchants of Misery: How Corporate America Profits from Poverty (Common Courage Press), and is a frequent contributor to Southern Exposure. (1998)

Mike Hudson, co-editor of the award-winning Southern Exposure special issue, “Poverty, Inc.,” is editor of a new book, Merchants of Misery: How Corporate America Profits from Poverty, published this spring by Common Courage Press (Box 702, Monroe, ME 04951; 800-497-3207). (1996)

Adam Feuerstein

Adam Feuerstein, a former reporter with the Atlanta Business Chronicle, is spokesman for the Task Force for the Homeless in Atlanta. (1993)