This article originally appeared in Southern Exposure Vol. 17 No. 1, "Meltdown on Main Street." Find more from that issue here.

The Financial Democracy Campaign has put together a detailed alternative to the bailout plan proposed by President Bush. The remedies call for vigorous prosecution of high-flying managers of bankrupted S&Ls, a renewed commitment to decent and affordable housing, and expanded supervision of the financial industry.

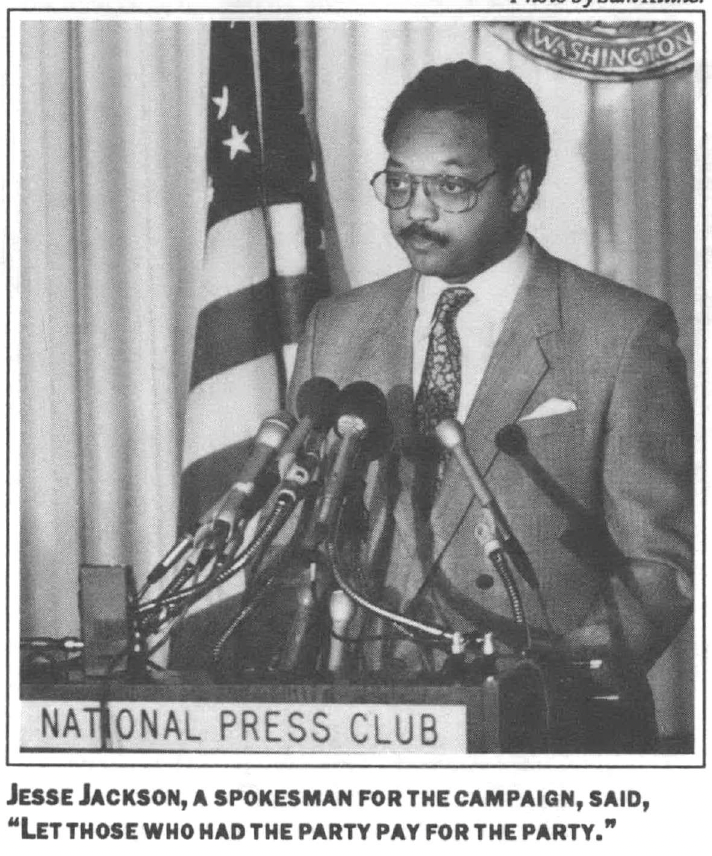

The remedies also insist that those who benefited from the mess should pay for any federal cleanup. Banks, S&Ls, big-time developers, wealthy investors and their brokers — all profited from years of high interest rates and deregulation of the financial industry, and all should pay for the bailout through higher taxes and increased fees.

In essence, this blueprint for reform is founded on a simple principle: If the government is going to continue to stand behind the financial industry through deposit insurance programs and the Federal Reserve System, then the industry must be required to serve the public interest.

Clean Up the Mess

✓ Include all bailout costs in the federal budget. The Bush plan calls for selling long-term bonds to finance the bailout and hiding most of the costs off budget. Putting the plan on the books will provide greater accountability and cut interest expenses.

✓ Limit the bailout to no more than 10 years. Spreading the bailout over 30 years, as Bush proposes, would only prolong the interest payments. A congressional study estimates that paying the bonds back in 10 years would save tax payers $80 billion.

✓ Raise taxes for the richest one percent. Individuals who make more than $200,000 reaped a bonanza of interest income from financial deregulation. Raising their tax rate to 33 percent — the highest bracket — would provide billions of dollars for the bailout.

✓ Slap a one-time penalty on brokerage firms. Companies like Merrill Lynch, which invest money for customers, kept billions of dollars flowing through hopelessly broke S&Ls, milking the industry for higher interest rates. They were part of the problem — and a one-time fee would make them part of the solution.

✓ Base insurance premiums on the size of accounts. Banks and S&Ls should pay bigger fees on large accounts and lower fees on small ones. Some of the extra money raised should be devoted to the bailout, while the rest would strengthen insurance funds.

✓ Spread bailout costs among all financial institutions. Every firm that does financial business in the U.S. is protected by taxpayers, so all should contribute reserves to a new Financial Markets Stabilization Fund. The fund would pay to merge or close troubled financial units, starting with insolvent S&Ls.

Provide Affordable Housing

✓ Create a new fund to make loans for housing. All financial firms should be required to invest in a Home Opportunities Fund, which would provide low-cost financing for first-time homebuyers and developers of affordable low- and moderate-income housing.

✓ Require S&Ls to invest in community development. The 12 district Federal Home Loan Banks that regulate thrifts should earmark some S&L money for non-profit groups working to develop low-cost housing.

✓ End discriminatory lending. S&Ls and other lenders should be required to report all rejected loan applications by race, income, and gender. In addition, federal regulators should be given enough resources to adequately watchdog lending.

✓ Give vacant buildings to those who need housing. The federal government should sell any buildings it acquires from bankrupt S&Ls to first-time homebuyers or low-income housing developers. Money from the sales should also be used to fund affordable housing.

Reform the Industry

✓ Restore deposit insurance to its original mission. Financial firms must be required to demonstrate that they invest publicly insured deposits in a manner that is safe, sound, and in the public interest

✓ Require full public disclosure. The financial industry and its regulatory agencies must be required to routinely report their actions to the public. Congress should also reexamine all sales of insolvent thrifts over the past year and create terms that are more favorable to the public.

✓ Restrict S&L investments. Congress should remove thrifts from the business of risky real estate deals and require them to devote most of their lending to housing.

✓ Give the public a voice. Public representatives should be placed on the governing boards of all financial firms that result from any merger or acquisition assisted by public funds.