Blue Sky & Big Bucks

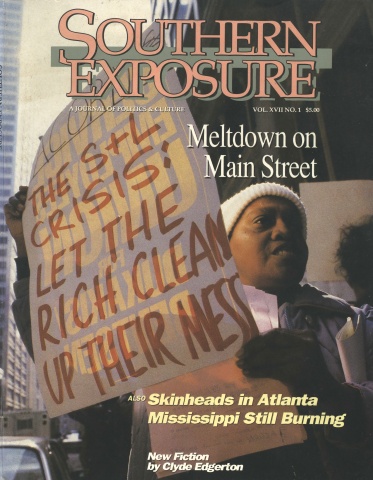

This article originally appeared in Southern Exposure Vol. 17 No. 1, "Meltdown on Main Street." Find more from that issue here.

San Antonio, Texas — Jesus Cardenas arrived at the Centro de Artes del Mercado in Market Square promptly at nine a.m. the morning of March 10. For the first time in over a month of damp chill, the sun shone in a cloudless sky. Cardenas had not come to the marketplace to shop — he was an hour early for a special meeting of the U.S. House Committee on Banking, Finance and Urban Affairs scheduled to investigate George Bush’s proposed $278 billion bailout of the savings and loan industry. The bailout is a response to the largest regulatory banking scandal in history.

San Antonio Congressman Henry B. Gonzalez, chairman of the powerful House banking committee and a longtime foe of banking deregulation, had picked the perfect stage for the hearings. After all, the savings and loan scandal started in Texas, and most of the insolvent S&Ls are scattered across the state. Now, 100 years after the Populist movement reached its peak in Texas, Gonzalez had come to a town hall sandwiched between sidewalk cafes to hear what average citizens had to say about the Bush bailout plan. Echoes of the state’s agrarian past reverberated through the all-but-deserted tourist trap early that morning.

Cardenas, a silver-haired, 75-year-old ex-hotel staffer, grinned through his moustache as he explained that he had a personal stake in the way the nation’s thrift industry bailout will be handled. “I’m a depositor, concerned about the effect of this bailout on economic cycles in this country,” Cardenas explained.

Marge Zimmerman, a retired realtor from the up-scale Alamo Heights section of San Antonio, was more angry than concerned. She and her husband T.K. Zimmerman expressed fears about the safety of family deposits in a San Antonio thrift. “One thing I’d like to see them do is something with these crooks that ran away with all the money,” Zimmerman told the San Antonio Light. “They should do to them like they do to dope dealers.”

Cardenas and Zimmerman were among dozens of concerned citizens who gathered in the meeting room throughout the weekend, along with a score of reporters, thrift industry experts and regulators, U.S. representatives and their staffs, and members of the Financial Democracy Campaign — a nationwide coalition of community, church, and grassroots groups which has put forward a populist alternative to the president’s proposal to restructure the thrift industry and its regulatory agencies.

“This savings and loan crisis is proof that the workings of the country’s financial system — a system that decides which economic sectors and which individuals get capital and what price they must pay for it — are too important to be left to a handful of bankers,” announced Jim Hightower, agriculture commissioner of Texas and a spokesman for the campaign. Hightower produced a voluminous report showing that the concentration of ownership of savings and loans has resulted in the curtailment of small business loans in rural areas of Texas.

“The truth is that any banking system is dependent on public trust,” Hightower continued. “For good reason, we don’t trust this one. Neither can we trust an industry restructuring that is designed by the same closed fraternity responsible for the crash of the old system, that concentrates control of our capital in fewer hands that are further removed from our communities, that asks taxpayers to bear all the risk, and that offers no public service or community involvement in return for our money.”

Although national news media tend to regard the savings and loan crisis as a peculiarity of the oil-patch economy, which collapsed when oil and real estate values plummeted in 1984, the staggering size and scope of the industry bailout has sparked a genuinely populist response across the country. Depositors, taxpayers, and community leaders have articulated the first national political agenda in generations designed to hold the financial industry accountable to the public.

“The present S&L crisis threatens to undermine the confidence of the American people in our country’s financial system and in the integrity of government,” testified Arthur Cross, a member of the Arkansas chapter of the Association of Community Organizations for Reform Now (ACORN).

Cross offered a simple prescription for the S&L crisis. “Avoid quick-fix deals made behind closed doors,” he demanded. “Take advantage of this opportunity to place savings institutions back on solid ground of service to their local communities.”

Deep in the Heart of Texas

The savings and loan crisis in America is first and foremost a Texas crisis. At the San Antonio hearings, officials testified that up to half of all federal bailout monies will flow into Texas to deal with problem thrifts throughout the state.

Indeed, the beginnings of the S&L scandal can be traced to Texas. By 1982, when Congress deregulated the industry, wheeler-dealers at Texas thrifts were already profiting from a booming economy and state regulations that allowed them to invest up to 100 percent of their assets in speculative real estate deals. Other states and Congress looked to Texas as a model. The new federal policy, coupled with expanded insurance coverage on thrift deposits, did more than unleash corruption — it set up a system that actually encouraged high-flying investments while providing virtually no accountability. Deregulation was a green light for greed, and Texas savings and loans plunged even further into reckless real estate deals, abandoning their historic commitment to providing loans to first-time homebuyers.

S&L executives in Texas created an intricate scheme of “land flips” — selling themselves the same properties over and over at progressively inflated prices. (See box.) As a result, their assets soared, from $23.8 billion in 1979 to $83.1 billion in 1986. To ensure that no one looked too closely at the shady deals, the industry made hefty political contributions to key congressmen and offered underpaid and overworked federal and state examiners high-paying jobs on the S&L payroll.

“Even though an S&L owner abused the system, made himself loans, pulled money out, acted in conflict of interest, the upcurve is like a steamroller,” explains T.W. Weston, a Houston S&L consultant and developer. “Even if you stole a million off the top, no one would notice, because during the same time period, the property went up in value $5 million.”

“If you didn’t do it, you weren’t just stupid — you weren’t behaving as a prudent businessman, which is the ground rule,” Weston adds. “You owed it to your partners, to your stockholders, to maximize profits. Everybody else was doing it.”

By 1984, however, falling oil prices had wrecked the Texas economy, leaving S&L officials stuck with hundreds of millions of dollars of commercial real estate loans that no one was going to pay. Hundreds of savings and loans found themselves swimming in red ink. Many were losing as much as $15 million a day.

An investigation by Texas Congressman Jack Brooks found that 80 percent of the 210 S&L insolvencies from 1984 to June of 1987 involved serious misconduct by thrift officials.

But that’s just the tip of the iceberg. Federal regulators released data to Brooks showing that fraud and insider abuse exist at an additional 313 “unhealthy” S&Ls still in business, and at another 295 healthy S&Ls. In other words, roughly one out of every four S&Ls suffers from fraud, management misconduct, or insider abuse.

The day before he was to appear at the San Antonio hearings, H. Joe Selby, a former federal regulator in Dallas, told the Senate Banking Committee that up to half the losses sustained by the thrift industry insurance fund in Texas and adjoining states may be the result of fraud.

“The combination of irresponsible deregulation of banking practices, unprecedentedly high interest rates for home loans, extraordinary tax cuts for the super-rich, and miserly budget reductions for housing programs was part and parcel of the ‘Voodoo Economics’ we’ve been practicing throughout the ‘80s,” Hightower testified. “Sure enough, just as we knew it would, the Voodoo has hit the fan.”

A Bitter Pill

In the best tradition of Texas boosterism, Texans are having trouble facing up squarely to the world-class problems in their financial system.

“What they deny is a simple, old-fashioned problem,” said Ned Eichler, visiting professor of business at Stanford and the University of California, who testified at the San Antonio hearings. “Texans seem to do everything bigger. This is the largest regulatory banking scandal in world history. Texans never imagined that oil prices wouldn’t keep going up. They thought that God so loved Texans that he ordained that oil prices must keep going up at all times. Now, they won’t even say that with all this real estate, what happened was a whole lotta shit got built that never should have been built. Now, it overhangs the market until somebody occupies it.”

Experts agree that rosy projections — combined with unbridled speculation and a traditional Texas distaste for government regulation — were a big part of the problem. What resulted was a business culture in which fraud and collusion flourished and government deregulation essentially socialized losses and privatized profits for the politically well-connected.

Texas businessmen have traditionally abhorred critical thinking of any kind. Not just because they’re anti-intellectual, but because any negative thoughts might interfere with the power of positive thinking and the creation of a positive public image. This mindless boosterism and uncritical acceptance of elite norms of behavior are the values Texas corporate culture enshrines as the ultimate moral, intellectual, and spiritual achievements.

This denial of reality coupled with aggressive boosterism has a long and time-honored tradition in Texas — as exemplified in a 19th-century advertisement for “Texas Universal Pills.” In the 1830s, the newly envisioned city of Houston, created in a swamp, had image problems, and a reputation for unhealthy living conditions. Despite the fact that one-twelfth of the population died during the fever season of 1839, local newspapers downplayed news of the epidemic. In the ad for “Texas Universal Pills,” the copywriter suggested that it was a Texan’s patriotic duty to take the pills to thwart critics who claimed Texas was an unhealthy place to live. It also proclaimed that Texans were the healthiest Americans around — any evidence to the contrary notwithstanding.

Evidence of the early Texas proclivity for seeing the “blue sky” in any real estate transaction can also be seen in an 1836 ad for the new city of Houston. The ad, which ran in newspapers across the country, claimed that downtown Houston was accessible by boat from New York and New Orleans — a patent falsehood.

An 1845 ad by the German Society of Texas sought to attract settlers to Houston with a similar ploy. The ad depicts a beautiful city nestled in the mountains along a winding river. A lovely vision, considering that Houston stands on a vast plain, without a mountain or river in sight.

Ned Eichler and other observers say that this long cultural tradition of misleading real estate speculation is reinforced by the Texas-style brand of fundamentalist Christianity. According to this view, those who find favor with the Lord will be blessed by material wealth. In effect, one’s spiritual condition can be judged by how expensive one’s car or clothes may be — and those without expensive cars or clothes are spiritually bankrupt. This theology puts a premium on material status, and helps explain how some pious Christian gentlemen came to participate in the largest banking fraud scandal in world history.

“People from other parts of the country, who don’t take themselves too seriously, and don’t think themselves bastions of virtue, will nevertheless say that the craziest people in business, the people who will lie to you the most, who will get you into crazy situations, are Texans,” laughs Eichler, the Stanford business professor. “It’s standard humor anywhere else in the country.”

Wide Open Spaces

One look at the extent of the S&L crisis in Texas confirms that it’s no laughing matter, however. The Dallas FBI office testified before Congress that losses for financial institutions under criminal investigation in the Dallas area may total $15 billion, and that fraud-related losses in Houston could easily match that figure. Unrecognized losses in Texas — those not even accounted for on the books — could reach an estimated $40 billion.

Such staggering losses make it clear that the entire Texas financial system will be in the intensive care unit for years to come. Equally important, however, are the implications for the rest of the country. George Bush fancies himself a transplanted Texan, and the U.S. economy under his administration bears an uncanny resemblance to the Texas economy just prior to the S&L collapse of 1986 — with its rosy scenarios denying widespread structural problems. As in the Texas of the early 1980s, the rest of the South and the nation are now borrowing money and building offices at a frenzied pace, running up huge debts in the process. The result, many observers say, will be the Texification of the American economy.

Just as Bush loves to dress up in custom-made cowboy boots and Stetson hats, his bailout plan is clothed in the Texan propensity to deny unpleasant realities and dismiss critics as “negative-minded” Yankees. Texas thrifts are stuck with huge, unpaid loans on empty office towers — yet Bush and most Texas leaders advocate a policy which pretends that real estate values are much higher than they really are. This strategy makes the bottom line look better than it really is and allows insolvent S&Ls to continue operating. Devaluing the loans to their real market value, Texas developers say, would wipe out almost all the barks and developers in Texas at once, causing a Wall Street crash and a world economic collapse.

Thus, because the Bush plan pursues a strategy of bailouts and mergers rather than simply shutting down insolvent thrifts, Texas will be stuck with a huge amount of foreclosed property for at least a decade. The vacant space will discourage potential buyers, depress real estate prices, and prevent new lending, construction, and development.

Unfortunately, rosy scenarios aren’t the only way the Bush economy mirrors the Texas disaster. Research shows that office vacancy rates across the country have tripled since 1980 — the same kind of real estate glut that fueled the S&L collapse in Texas. “Office vacancy rates are increasing,” says Charles Clough, chief investment strategist at Merrill Lynch, “and the rising tide of real estate defaults which now show little geographic bias are daily news events.”

Between March 1987 and March 1988, the number of new and existing homes for sale rose from 2.6 million to 3.2 million. By last year, prices for single-family homes had fallen in a third of the metropolitan areas surveyed. In most areas, the rise in home prices has not kept up with inflation. According to Comstock Partners, a New York-based investment research firm, the weakened real estate market has spread beyond the Texas oil patch to Florida, Arizona, Utah, Washington, and the Northeast.

“New regions of the United States now seem vulnerable to real estate overbuilding,” agrees George Salem, a banking analyst with Prudential-Bache Securities. According to Salem, excess real estate could soon plague Georgia and Florida, and eventually spread to Massachusetts, Connecticut, New Jersey and Arizona.

Other observers echo the same warning about rising vacancies and falling real estate prices. “Since the average American family has almost twice as much wealth lodged in property than it does in the stockmarket, a decline in house prices could have a much more immediate psychological effect on the economy than did last October’s stockmarket crash,” the London Economist reported. “It would in due course feed through to the balance sheets of thrifts and banks. In Texas, it has already done so.”

Big Debts, No Growth

Empty offices and tottering real estate values aren’t the only thing pushing the U.S. economy to the edge of a Texas-sized abyss. Corporations across the country are doing their share, running up debts that would make Texas S&L executives proud. Since 1982, corporate debt nationwide has nearly doubled to $1.8 trillion.

“Corporations, on average, must now commit 50 percent of their earnings to finance their debt, up from 33 percent in the 1970s and 16 percent in the 1950s and 60s,” observes Vince Valvano, staff editor of Dollars & Sense magazine. Valvano cites a recent study by the Brookings Institution which predicts that, given current corporate debt levels, at least 10 percent of U.S. corporations would go bankrupt in a downturn comparable to the 1973-74 recession.

All these structural problems combine to create a situation that makes continued economic growth unlikely. Under George Bush, the federal government has been backed into a position similar to that of the bold Texas entrepreneurs who promoted fraudulent land flips and sky-high scenarios for endless growth. Yet even though falling real estate values and rising debt make growth iffy at best, Bush and a host of mainstream economists base their programs on a firm belief that the U.S. has seen its last big recession.

Without the endless growth projected by the Texas-style Ivy Leaguers in Washington, many observers say, the economy will be faced with a Texas-style disaster. “Despite Mr. Bush’s ringing call for bipartisan cooperation, his maiden effort before the Congress repeated Mr. Reagan’s major budgetary sin — assuming that economic growth alone will solve the structural dislocation,” says H. Erich Heinemann, chief economist for Ladenburg, Thalmann, and Company.

Economist James K. Galbraith agrees. “There is no doubt whatever that the financial problems of U.S. banks and companies can be managed,” he contends, “provided that growth continues. But it is reasonable to fear that a recession might put the situation out of control.”

Thus, what underscores the Texification of the economy is an insistence on seeing blue skies in the middle of one of the worst financial storms in history. Much of the Bush bailout plan, for example, will be conducted “off budget” — in other words, the huge costs of bailing out insolvent S&Ls won’t show up in the federal budget.

“We owe all this money from the trade deficit from the budget deficit, the savings and loan deficit, and the nuclear waste deficit, which is unbudgeted — on nobody’s balance sheet” says Ned Eichler, the Stanford business professor. “Nobody will admit that they owe the money. Therefore, you can argue that we all get up every morning and we spend the first two or three hours at work paying off the old debts. We have to earn enough to get even before we can start earning something extra.”

Eichler notes that every major U.S. depression was preceded by increased borrowing and a rise in the number of bank failures. “When the depression came, it was arguably not caused by this borrowing, but the borrowing greatly exacerbated the depression,” he says. “In 1926, for instance, the Florida real estate boom of the 1920s burst, long before the depression. Arguably, that was the equivalent of Texas in 1986.”

Eichler believes that the country simply has too many banks and savings and loans. “Canada has 38 banks,” he says. “We have 14,000. Banks get chartered every 40 minutes in America.” Bank owners shop around, he adds, until they find the most lenient regulator. “You play regulators against each other. So with this type of historical situation, you have tremendous booms, and then a tremendous real estate collapse is possible.”

In essence, Eichler concludes, the rest of the economy now appears to be gambling with speculative real estate deals and heavy debts — just as Texas did before the crash. “What is now going on in other parts of the country is that the accumulation of credit underpinning the economy — and real estate has played an enormous part in this — has become a virtual chain letter. Mere speculation. It collapsed first in Texas, and will collapse at some later date throughout the country.”

Lock ’Em Up

As the Texification of the economy continues, more and more citizens will come to share the skepticism of the activists who came to the congressional hearings in the Mercado of San Antonio.

As testimony droned on through the afternoon, expert after expert claimed that fraud and corruption in the savings and loan industry were not as bad as the general public perceived them to be. “We don’t have a thrift problem or a banking problem,” insisted George Barclay, president of the Federal Home Loan Bank Board in Dallas. “We have a real estate problem.”

But Antonio R. Esparza, 70, a retired Kelly Air Force Base worker who was standing in the back of the meeting hall, didn’t buy the excuses. He wanted to see white collar criminals locked up.

“What they ought to do is put a few of them in jail to wake up the rest of them,” Esparza said.

The growing outrage of depositors like Esparza makes it clear that the San Antonio hearings were only the opening skirmish in what promises to be a long, drawn-out battle for control of the country’s financial institutions. Esparza and others insist that only the continued confidence of depositors and taxpayers can prevent disaster. Bringing criminals to justice, they say, is a small price to pay for that trust and confidence.

Tags

Curtis J. Lang

Curtis J. Lang is a freelance writer in Austin, Texas. (1988)