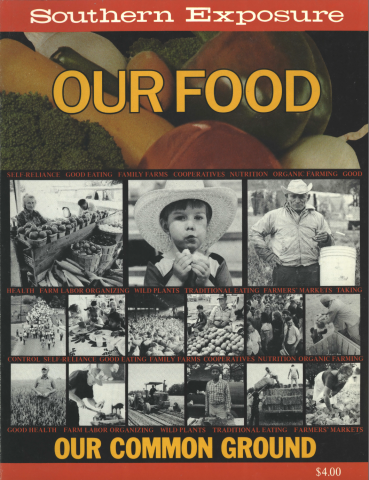

This article originally appeared in Southern Exposure Vol. 11 No. 6, "Our Food." Find more from that issue here.

On a sunny Saturday in October, 1983, the Acadian Delight Bakery of Lake Charles, Louisiana, held a party. It was the twentieth anniversary of the founding of the bakery, Lake Charles’s only black-owned and -operated cooperative business.

The Acadian Delight began as an experiment in black economic self-sufficiency; it has not only survived two decades but has also spawned a number of other ventures, including a small loan co-op for the black community of nearby Lafayette and a flourishing development fund that sustains cooperatives all over the South.

The board members of the bakery’s umbrella group — the Southern Consumers Cooperative (SCC) — had much to celebrate as they gathered at the bakery around a table loaded with ribs, chicken, sweet potatoes, cakes, and cookies. Outside the bakery, a local soul station turned up the volume on their special live broadcast of the birthday. Inside, Acadian Delight’s bakers arranged trays full of free bakery samples, including several kinds of cookies, brownies, and pecan-studded chunks of the bakery’s specialty: fruitcake.

It was the redolent, rich fruitcake that sparked the co-op in the first place. The Reverend A.J. McKnight, a Catholic priest who was then setting up literacy programs in south Louisiana, saw a co-op bakery as a way to cultivate both skills and independence.

“Father McKnight wanted blacks to begin owning and controlling their own businesses,” recalls Christiana Smith, an SCC board member who has been a moving force since its inception in 1959. “But he realized he had to start with literacy.” Smith remembers black adults lining up to learn to read and write at McKnight’s program in Lafayette. “Everybody came,” she says. “It was the first time anything like that happened.”

Smith had been teaching school since 1938, and she felt the same burning ache to see the black community on its feet. “We had nothing going,” she says, a frown flitting across a still smooth face, which reflects her Louisiana Indian ancestry. “Blacks were just existing.”

Alfred McZeal remembers the feeling, too. McZeal, current general manager of SCC, was making $40 a week then at Morgan and Lindsay, a Lafayette five and dime. Friends told him of the meetings McKnight was holding where co-ops and credit unions were discussed. To most people in the rural and undeveloped parishes of Louisiana, these were foreign terms; curious, McZeal attended.

“I went and asked, ‘What is a co-op?’ They told me, ‘Co-ops are a way to own and control business and create more jobs.’ I said, ‘Wow.’ To me these were beautiful words.”

SCC members began selling $5 shares in 1961 — and McZeal bought his. He started going door-to-door after-hours from his job at Morgan and Lindsay, selling co-op shares for a commission. His enthusiasm for the concept seemed contagious and he quickly became a top share-seller.

“About this time, Morgan and Lindsay closed,” says McZeal, “and Reverend McKnight asked if I would work for SCC full-time. He offered me $60 a week. I took it, but I didn’t believe they’d be able to afford to keep me.”

Support for the co-op did keep growing, however, and finally attracted the eye of Washington, DC. The Acadian Delight Bakery received the nation’s first War on Poverty loan. A black and white photograph of a beaming Vice President Hubert Humphrey holding the $25,000 check is still displayed on a bulletin board at the bakery.

More than on government loans, the bakery rested on the dreams and enthusiasm of the co-op members. “It was our baby,” recalls McZeal with a wide grin that highlights the laugh lines on his round, cheerful face. “It also became our university.”

The first few years were flush. “We had 35 employees,” says Laura Rivera, who was then manager. “We were putting fruitcakes out by the ton,” in addition to a full bakery fare. Much of the business was in mail orders from companies from California to New York.

As with most learning experiences, there were a few hitches. Recalls McZeal, “We got this ‘expert’ who told us he could have the bakery making $1 million in six months. In the next year, we lost $200,000. We basically made too many cakes and couldn’t sell them.”

With the disappointing deficits, “we lost a lot of steam,” McZeal says. The bakery tried to market “stage planks,” a thick moist slab of gingery cookie. “It sold good, but not good enough.”

Eventually, the bakery was open only a few months during the holiday season for fruitcake production. Meanwhile, bakery shelves were converted for sales of groceries, sandwiches, and liquor, and their sales offset bakery losses.

However, the baker board members, especially McZeal, didn’t want to let go of the fruitcake idea. “I just didn’t want to say quit,” McZeal says. “I had rassled with those fruitcakes so long that Acadian Delight had become a part of me.”

So, in August of 1983, the bakery ovens were heated up again and the results have been good. “Bakery sales are well over 50 percent of the total sales here,” says store manager Larry Bellow. Last month, bakery sales were up to $14,000. Rivera, baking again at Acadian Delight, reports that lemon meringue, blueberry, and sweet potato pies are fast sellers. She’s not concerned that the shares haven’t paid off yet. “Someday,” she says quietly, “they will.”

McZeal predicts continued success. “We sold 29,000 fruitcakes last year and 1 bet we double that this year. We do have the best fruitcake in the world.”

During the years that the bakery struggled to survive, several other programs developed under the SCC umbrella. People’s Enterprises, which grants household loans to the black community at lower than conventional rates, remains a key component. “We’re charging 14 percent, compared to 16 to 18 percent downtown,” said manager Howard McZeal. “Last year, we granted about 200 loans for a total of about $250,000.”

Crucial to People’s Enterprises is its technical assistance services. “We teach people how to manage their money, and it makes a lot of difference,” says Howard McZeal. This service, plus a no-nonsense loan payback policy, has paid off for People’s Enterprises. “For the first time in 10 years, People’s Enterprises is finally in the black,” triumphs Alfred McZeal.

Another successful SCC project was its move in 1973 to build itself a new office building and rent out much of the space to other small businesses. SCC also invested $18,000 in land adjacent to the office building, which they sold recently for $220,000. They also own a rental house and a trailer park.

One SCC offspring did not fare so well. In 1965, SCC’s Southern Consumer Education Foundation was making big gains in the community with a Head Start program. In addition to the pre-school program they also offered remedial education, voter education, and legal help. Alfred McZeal contends that these successful programs were too threatening to the white community.

“The school board here didn’t even try for the Head Start funds at first,” he says. “But then they saw the government contract was awarding $1 million, then $2 million the second year to us to run the program. We were making jobs for people, and this was threatening.”

McZeal says the group was accused of “being communist,” apparently in part because one staff member had been on an exchange trip to Russia while in college. “The state legislature spent $50,000 investigating us,” he recalls. “They seized all our books. Of course, they could find nothing about communism. But by the time we took it to court and were exonerated, the federal government had been scared off,” says McZeal. “The school board then got the contract. It also took us a long time to counteract the bad image. But we did.”

Efforts of the Educational Foundation continue, however, with a scholarship fund that annually awards around $4,000 to 10 college-bound blacks. The money comes from a 1 percent salary contribution from SCC staffers. The foundation also holds “Black Citizen Award Nights” to cite individuals who’ve been especially responsive to the community.

Perhaps the most far-reaching educational tool is the monthly Southern Consumer Times, begun in 1976. The tabloid tackles community issues the Lafayette dailies ignore, says McZeal. Now self-supporting through advertising, the Times is distributed free, mostly in area churches.

SCC’s biggest offspring, though, has been the Southern Cooperative Development Fund (SCDF). The SCDF funnels loans to co-ops of all descriptions — food, health, farming, community development — in 16 Southern states. Through its technical assistance division, SCDF teaches co-ops about everything from profitability techniques and management training to evaluation systems to help stabilize businesses.

McZeal learned long ago why such development agencies are paramount. “The co-op had needed a $5,000 loan, and we thought that with the $20,000 in assets we had at the time, it would be no problem,” remembers McZeal. “But we went to the downtown banks and they sent us away quick.”

It’s a different story now for SCDF’s 74 members, who are also shareholders. They’ve used SCDF to realize a rainbow of dreams — from the Greenhale Sewing Cooperative of Greensboro, Alabama, to the Citizens Coal in Clintwood, Virginia, to the St. Landry Low Income Housing in Palmetto, Louisiana, to the Sea Island Farmers’ Cooperative in Frogmore, South Carolina. SCDF’s executive vice president Marvin Beaulieu notes that loans are granted for a maximum of $500,000. In its 13-year history, SCDF has approved more than $ 13 million in loans.

But SCDF is having increasing money worries, since almost 40 percent of its revenues had come from federal Community Service Administration (CSA) grants. The Reagan administration abolished CSA, so SCDF has had to look elsewhere. The Emergency Black Survival Fund has been set up, with money raised through direct mail.

The umbrella group has also taken on a subsidiary called the Ceres Corporation, a vegetable farm in Myakka City, Florida. Currently, some 180 acres of tomatoes, cucumbers, cabbage, bell peppers, cauliflower, eggplant, and jalapeno peppers are in production. The farmers there are keeping bees to pollinate plants for increased production, and they recycle farm water. Eventually Ceres hopes to develop its own packing and processing plants and market its own products, independent of area packing houses. All land improvements are geared toward the original plan for the land. When funds are available, the farm will be converted to a group of small farms housing resident families, working as an agricultural community.

People’s Enterprises, the Southern Consumer Educational Foundation, Southern Consumer Times, the Southern Cooperative Development Fund: all of these spring from the same root principles as does the Acadian Delight Bakery. In each case, people are getting jobs, plus something more: control over their own lives. Laura Rivera, once general manager and now a baker at Acadian Delight, is a firm believer in the co-op concept. “I think this is a good thing. I bought shares when I first came. I knew it keeps jobs and money in the community.”

Tags

Helen Cordes

Helen Cordes is free-lance writer who lives in Baton Rouge. (1983)